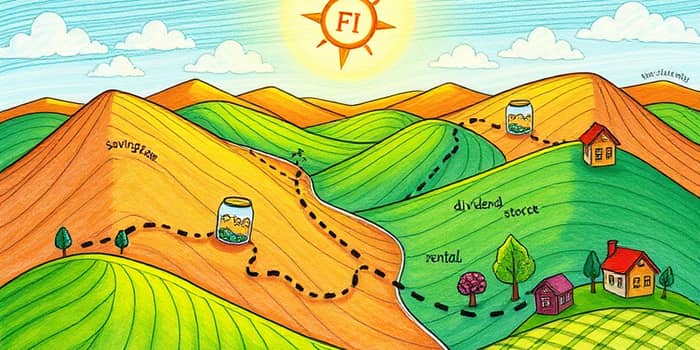

Imagine setting sail on a vast ocean with no chart or compass. You might drift for days, unsure of which direction leads home. Your personal finances can feel similarly overwhelming without clear guidance. This article offers a comprehensive map to guide you step by step toward true financial freedom and peace of mind.

Whether you dream of early retirement, traveling the world, or simply eliminating money worries, this roadmap is designed to inspire and equip you. Follow each section to build momentum, avoid common pitfalls, and ultimately reach your target destination.

Every journey begins with a realistic assessment of where you stand today. Gather statements for income, expenses, assets, and debts. Use a spreadsheet or an app to track every inflow and outflow for at least a month.

By creating a clear snapshot of your finances, you’ll know exactly how much passive income you need to cover living expenses. This clarity transforms abstract aspirations into concrete targets.

Next, define where you want to arrive. Do you aim to retire at 45? Cover $50,000 of annual expenses with dividends? Launch a business and work part-time? Your objectives should be specific, measurable, time-bound goals to maintain motivation.

Consider the 25x Rule: multiply your annual expenses by 25 to find the portfolio needed for a sustainable 4% withdrawal. For instance, $40,000 per year requires roughly $1 million invested. Use this formula as a north star.

With your starting point and destination mapped, it’s time to chart the course. A reliable roadmap blends budgeting, debt elimination, emergency savings, aggressive investing, and income growth. Approach each step methodically to build lasting momentum.

To stay on course, adopt proven financial rules and leverage powerful tools. Familiarize yourself with the 4% Rule and the 25x calculation to gauge readiness. Use automated budgeting apps and calendar reminders to maintain consistency.

Once your core roadmap is in motion, explore specialized pathways within the FIRE movement. Lean FIRE emphasizes extreme frugality for rapid progress, saving over 50% of income. Barista FIRE blends part-time work with a smaller portfolio withdrawal. Fat FIRE allows a more luxurious lifestyle at retirement.

Analyze which variant aligns with your values and adjust your savings rate, investment mix, and living standards accordingly. Remember that entrepreneurial ventures can accelerate returns and add a balanced portfolio of income assets.

Long journeys face detours. Inflation, market volatility, and lifestyle creep can derail progress. Schedule quarterly reviews to compare actual performance against projections. Stay informed through reputable financial blogs and books.

Develop systems for automated, frictionless investment contributions to minimize temptation and maximize consistency.

No journey begins without motion. Start by tracking this week’s spending and identifying one expense to cut. Then automate a small monthly transfer to a high-yield savings account or brokerage.

Your money map starts with a single entry. Over time, each deposit, each review, and each informed adjustment will draw you closer to the horizon of true financial independence. Embrace the process, celebrate milestones, and know that every step forward strengthens your path to freedom.

References