In an era of fast-changing economies and shifting life goals, traditional budgeting alone can feel limiting. We need a broader perspective that embraces the full range of savings and investment possibilities.

By viewing your finances as part of a spectrum of personal investments, you gain clarity on how to navigate low-risk accounts, high-potential investments, and everything in between.

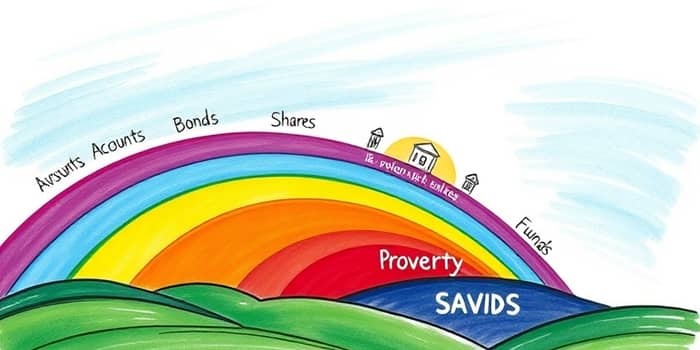

At its core, the savings spectrum spans a variety of products—from simple deposit accounts to complex commodities and funds. Each point along this continuum balances risk and reward in its own way.

Understanding this spectrum helps you craft balanced and adaptable financial strategies that evolve as your circumstances change.

The fundamental principle behind any savings or investment choice is the risk-return relationship principle. Low-risk products tend to deliver modest, steady returns, while higher-risk opportunities can yield significant gains but come with the chance of losses.

Remember the adage: “The safest way to double your money is to fold it in half.” Promises of outsized returns often carry hidden dangers.

Savings products vary in accessibility, interest rates, and tax treatment. Choosing the right mix depends on your goals, time horizon, and comfort with volatility.

To compare rates effectively, look at the Annual Equivalent Rate (AER), which factors in how and when interest is paid.

If you’re willing to accept principal fluctuations, investments such as shares, bonds, commodities, and funds expand your potential for growth.

Investments carry warnings about capital risk because prices can fall as well as rise. That’s why monitoring your portfolio’s total return, including dividends and capital gains, is essential.

Credit ratings (AAA, AA, A, BBB) provide a quick gauge of bond safety, while funds offer instant diversification even with modest contributions.

Moving beyond basic tracking, advanced budgeting integrates forecasting, scenario planning, and continuous adjustment.

By adopting data-driven decision making, entrepreneurs and families can turn budgets into strategic roadmaps.

Every personal journey differs, so choose a method that motivates you:

These frameworks encourage discipline while leaving room for personal enjoyment.

True financial freedom arrives when passive income covers living expenses. Building toward that goal involves disciplined saving, prudent investing, and regular plan reviews.

For example, a physician aiming to retire in 20 years with a $3.75 million nest egg must save roughly $115,000 annually at a 5% real return. Adjusting the timeline or target alters monthly savings needs, illustrating the power of scenario-driven planning.

Numbers matter, but so do your passions. A values-based approach ensures that every investment choice resonates with your personal mission—whether it’s funding education, supporting causes, or building generational wealth.

Modern financial planning platforms now offer collaborative portals, goal tracking, and 24/7 access, democratizing access to professional guidance across the wealth spectrum.

Your financial journey is not a series of transactions, but a living narrative that adapts as you grow. By embracing the full savings spectrum, you gain the tools to fund dreams, weather uncertainties, and celebrate milestones.

Let this inspiring framework guide you beyond spreadsheets and into a world where your money works in harmony with your values, ambitions, and life’s unfolding story.

References