In an era of rapid market shifts and evolving economic landscapes, investors must adopt a proactive mindset to maximize ROI through disciplined strategies. Whether you are just starting or have decades of experience, harnessing proven tactics can turn every dollar into a building block for lasting wealth.

This comprehensive guide explores the pillars of strategic planning, diversification, efficiency, timing, and advanced tactics. By weaving theory with practical examples, you will gain actionable insights to navigate uncertainty and achieve growth.

Effective investment begins with research and goal alignment. Before deploying capital, conduct thorough market analysis, evaluate industry cycles, and define your objectives—be it retirement security, wealth preservation, or aggressive expansion.

Assess risk tolerance against time horizon. A five-year goal demands a different approach than a thirty-year plan. By charting milestones and potential setbacks, you create a roadmap that adapts as conditions change.

Timing can amplify results. By choosing entry points during capitalize on economic growth cycles and avoiding peaks of exuberance, you set the stage for outperformance. This foresight separates casual savers from savvy investors.

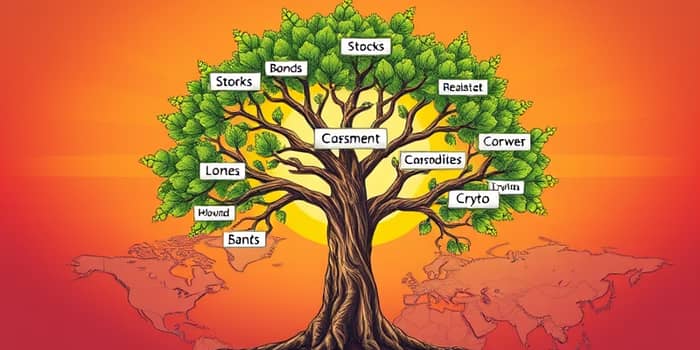

Spreading capital across various assets reduces volatility and unlocks a spectrum of returns. Embrace the principle of uncorrelated holdings to cushion downturns and seize emerging opportunities.

These structures reduce volatility and capture opportunities, ensuring your portfolio can thrive in diverse environments. By holding gold or commodities, you guard against inflation. By owning bonds, you gain stability when equities falter.

Constructing a balanced portfolio requires a disciplined sequence of actions. Follow these stages to align your holdings with objectives and risk preferences.

Tools like robo-advisors and smart beta ETFs can automate many of these tasks, combining Modern Portfolio Theory with automated rebalancing to uphold discipline and match investment goals to timeline.

This illustrative table demonstrates how allocations shift with risk appetite. Tailor these percentages to your unique circumstances for optimal results.

Once your core portfolio is in place, layer on sophisticated strategies to boost yield and efficiency. These methods can enhance returns but require careful execution and monitoring.

These advanced approaches can drive incremental gains and balance risk tolerance with growth when applied judiciously.

Emotional reactions often derail the best-laid plans. Recognize your tolerance for drawdowns and adhere to predetermined rebalancing rules to avoid panic-driven trades.

Utilize dollar-cost averaging to smooth entry points, investing fixed amounts at regular intervals. This habit diminishes timing risk and avoid emotional decision-making pitfalls.

Regularly revisit your goals and consult advisors or peer insights when markets become turbulent. By maintaining a long-term perspective, you can resist herd behavior and preserve compound growth.

To translate strategy into results, commit to continuous learning and rigorous execution. Track performance metrics, keep a watchlist of potential opportunities, and document lessons from both wins and setbacks.

Start today by reviewing your current allocation, identifying gaps, and scheduling your first rebalance. Small, consistent steps build momentum toward compounding returns over time.

Your path to financial resilience begins with disciplined action. Embrace these frameworks, adapt to evolving markets, and watch as every dollar works harder to secure your future.

References