In the intricate world of personal finance, managing your investments can feel overwhelming, but a timeless strategy offers clarity and direction.

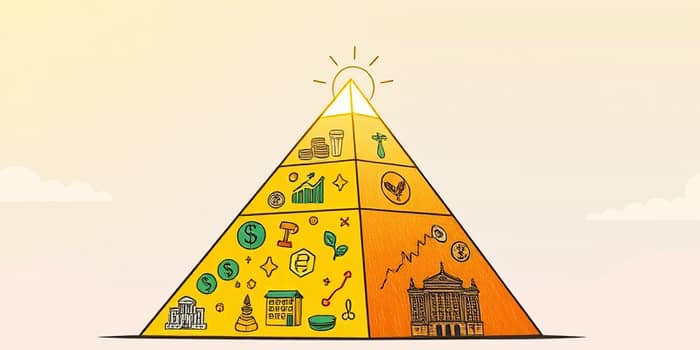

The portfolio pyramid is a visual framework that organizes assets by risk, providing a structured path to wealth accumulation.

It stacks investment types from the safest at the bottom to the most speculative at the top, ensuring your financial foundation remains unshaken.

At its core, the portfolio pyramid is an asset allocation tool designed to align your investments with your personal goals and risk tolerance.

It doesn't prescribe specific securities but guides the proportion of your wealth allocated to different risk categories.

This approach helps prevent common mistakes, such as placing essential capital in high-risk ventures that could jeopardize your stability.

Think of it as a financial hierarchy, similar to Maslow's pyramid of needs, where basic security must be established before pursuing higher aspirations.

The foundation of the pyramid is dedicated to low-risk assets, forming the broadest layer that ensures capital preservation and liquidity.

This layer is crucial for meeting near-term needs, such as emergency funds or short-term goals within one to three years.

It serves as a psychological buffer, offering peace of mind during market volatility by preventing forced sales of volatile holdings.

Typically, this base should comprise a significant portion of your portfolio, often recommended as 40–50% for conservative investors.

Above the base lies the middle tier, focused on moderate-risk assets that drive long-term growth and generate income.

This layer balances capital appreciation with returns like dividends or interest, typically suited for time horizons of five to eight years or more.

It acts as the core engine of your portfolio, harnessing the power of diversified assets to build wealth steadily over time.

Diversification is key here, spreading investments across asset classes, sectors, and geographies to mitigate risks.

At the narrow top of the pyramid, speculative assets offer the potential for high returns but come with elevated risk and volatility.

This layer should represent only a small fraction of your portfolio, reserved for money you can afford to lose without impacting your essential needs.

It includes investments like cryptocurrencies, options, collectibles, and alternative assets that can diversify returns but may experience significant swings.

The goal is to boost overall performance selectively, without compromising the stability of your lower layers.

The portfolio pyramid is not a one-size-fits-all model; it should be customized based on your life stage, risk tolerance, and objectives.

Younger investors might allocate more to growth layers, while those nearing retirement may prioritize safety to preserve capital.

Regular reviews and adjustments ensure your pyramid evolves with changing circumstances, such as career shifts or family needs.

This adaptability makes it a dynamic tool for lifelong financial planning, fostering resilience and confidence.

Implementing this framework starts with assessing your current assets and defining clear financial goals, such as saving for a home or retirement.

Begin by establishing a robust base with adequate emergency funds, then gradually add growth and speculative elements as your wealth grows.

Monitoring performance and rebalancing periodically keeps your pyramid aligned with market conditions and personal milestones.

This proactive approach empowers you to navigate economic cycles with composure, turning challenges into opportunities for growth.

In conclusion, the portfolio pyramid is more than just an investment strategy; it is a holistic approach to financial well-being that balances security with ambition.

By structuring your assets thoughtfully, you can build a resilient foundation, harness growth potential, and explore high-return opportunities without undue risk.

Start today by evaluating your current holdings and sketching out your own pyramid, taking the first step toward a more secure and prosperous future.

References