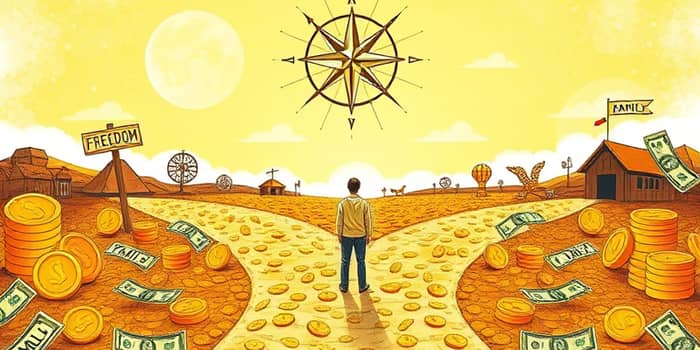

Money often feels like an impersonal series of rules and numbers, but it doesn’t have to be that way. By defining a clear money mission, you can transform your finances into a tool for living with purpose and joy.

A money mission is more than a financial plan; it’s a concise statement that captures what you want money to do for your life and how you will use and manage money to support that vision. Instead of focusing solely on saving percentages or investment vehicles, it centers on your personal values and long-term goals.

Financial Social Work experts describe a money mission as a powerful catalyst for behavior change. It helps you identify your deepest priorities and design financial habits that reinforce them every day. When you link spending and saving to a purpose, money decisions become inspiring rather than burdensome.

Traditional personal finance often relies on one-size-fits-all rules and budgets, leaving many individuals feeling overwhelmed, anxious or guilty about money choices. Without a clear purpose, it’s easy to lose motivation and never truly know where your money goes.

By crafting a money mission, you gain:

Creating a money mission is just the start. You need a step-by-step framework to translate purpose into concrete goals and everyday habits.

Follow this roadmap to bring your money mission to life:

Supporting your money mission requires solid financial literacy. These core domains will give you the tools to succeed:

Mastering money missions means weaving purpose, planning, and persistence into everything you do. As your income grows or life changes, revisit your mission statement and adjust goals to stay aligned with what matters most.

Regularly reflect on these questions:

By approaching money as a dynamic instrument for living your chosen life—rather than a source of stress—you gain true ownership and empowerment. Your money mission becomes a faithful compass, guiding each decision toward lasting fulfillment and impact.

Begin today: write your statement, set your first goal, and take one small action that honors your vision. Over time, those deliberate steps will compound into profound change. Welcome to the journey of mastering your money missions.

References