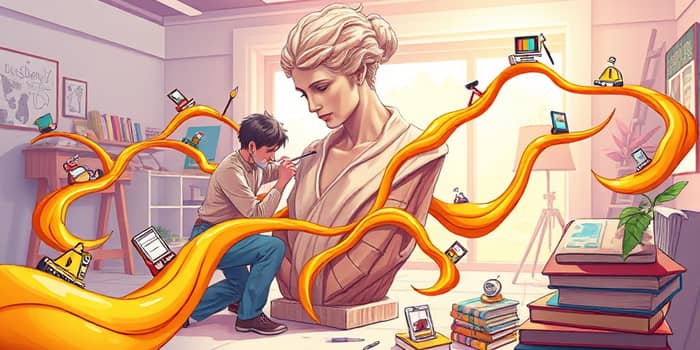

In today’s fast-changing creative economy, relying on a single paycheck can leave you vulnerable to unexpected shifts. Income stream sculpting invites artists and freelancers to intentionally design a resilient revenue portfolio, blending active and passive sources for long-term freedom.

Imagine your earnings as a spinning roulette wheel—thrilling when it lands on a win, but unsettling when it doesn’t. Many creatives know the highs of a big commission and the lows of quiet months. This “income roulette” can fuel stress and stifle creativity.

By contrast, an “income architecture” approach treats each revenue source like a building block. You combine client work, digital products, licensing deals, and community support to craft a stable, versatile structure that can adapt and grow.

Strategic diversification brings measurable advantages. Whether you’re an emerging painter or a seasoned designer, balancing multiple sources can transform your financial and creative life.

To sculpt income streams effectively, classify opportunities by effort type. This simple framework helps you balance time-bound work with scalable products.

Your primary service or original artwork often seeds your financial portfolio. Custom commissions and client projects offer high-value, premium pricing opportunities and direct creative fulfillment.

However, these projects tend to be unpredictable. Income halts when you pause work, and tight deadlines can spark burnout. Treat this core craft as the bedrock, but not the sole pillar of your revenue plan.

Once you establish your foundational income, channel your art into tangible or digital goods. Prints and merchandise let you multiply one design across many buyers. Options include print-on-demand platforms for posters, mugs, apparel, and more.

Digital assets—clipart packs, Procreate brushes, printable coloring books—require no shipping and scale globally. Invest time upfront in quality production and clear marketing, then watch sales trickle in around the clock.

Teaching and sharing expertise are powerful levers. In-person workshops often generate immediate cash and help you cultivate a local following. A weekend painting class can net $500 or more, while building meaningful community ties.

Transition to online courses or live cohorts to multiply your impact. Many creators report their best earnings from pre-recorded programs, which can surpass commission income once enrolled students accumulate.

Coaching, consulting, e-books, and templates serve as mid-level offers, guiding learners through pricing, marketing, or technique challenges. Predictable, scalable revenue streams emerge when you leverage these educational products.

Licensing transforms existing work into ongoing revenue. By granting reproduction rights for specific uses—apparel, home goods, editorial—artists earn royalties long after the initial sale.

Similarly, authorship and publishing can open doors to advances and perpetual royalties. A well-crafted coffee-table art book or how-to guide positions you as an authority and generates passive income over years.

Membership platforms like Patreon or Substack unlock steady recurring income in exchange for exclusive content, behind-the-scenes access, or a tight-knit community experience. Fans pay monthly to support your journey and receive value directly from you.

These community-based streams anchor your portfolio, reducing reliance on one-off transactions. They foster loyalty and offer real-time feedback loops, fueling new product ideas and strengthening your brand.

Sculpting a durable income architecture requires clarity on your goals, honest assessment of your skills, and disciplined execution. Use this five-step roadmap to begin crafting your diversified portfolio:

By treating income as malleable material, you can carve out a portfolio that balances security with artistic freedom. Embrace the process of continuous iteration—tweak pricing, adjust marketing, and reallocate time to the streams that best align with your evolving goals.

Ultimately, income stream sculpting empowers you to say no to misaligned projects, invest in passion-driven work, and build a life where creativity and stability coexist. Begin shaping your unique revenue paths today, and watch your artistic career flourish with confidence and purpose.

References